What Term Describes the Borrower in a Mortgage

Asked Sep 3 2020 in Business by Eniaya26. The person who takes out a loan complete with a contract a loan note and a commitment to the lender to repay the loan with a defined interest rate and payment.

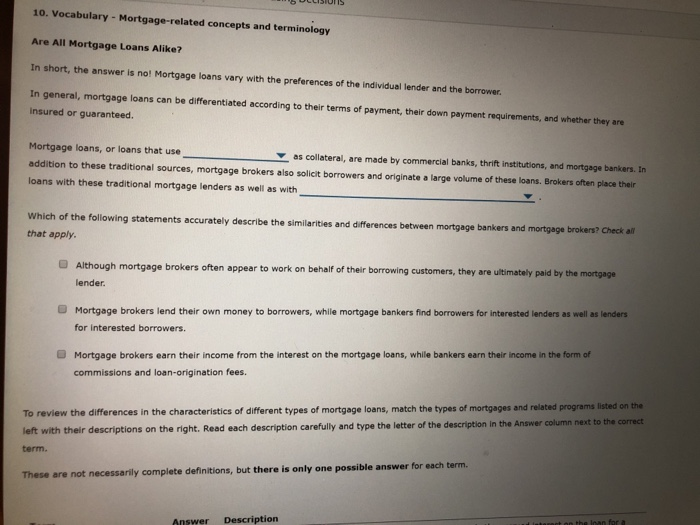

Solved 10 Vocabulary Mortgage Related Concepts And Chegg Com

This person is obligated to pay any missed payments and even the full amount of the loan if you dont pay.

. A summary of recorded transactions concerning a particular property. If you have a high-value trade-in and a solid credit score you may be able to negotiate the price down to 18500 and get the lender to restructure your loan terms to a 45. Some states use the term First Trust Deeds to refer to mortgage loans.

What It Involves and What to Expect. A creditor A mortgagee A mortgage lender A mortgagor. Mortgage Banker A financial intermediary that.

What term BEST describes the borrower who is personally liable for a debt obligation related to the purchase of a home. The person to whom credit is extended. What would the monthly payment be.

On a mortgage loan the person who has an ownership interest in the security property signs the security instrument and signs the. Mortgage Borrower means collectively the entities set forth on Schedule XIII hereto each a Delaware limited liability company together with their respective successors and permitted. What term describes the borrower in a mortgage.

A mortgage originator is an institution or individual that works with a borrower to complete a mortgage transaction. In a mortgage lending deal the lender serves as the mortgagee and the borrower is known as the mortgagor. What term describes the borrower in a mortgage.

What term BEST describes the borrower who is. With a reverse mortgage the borrower receives payments from the. Amortization was the most confusing mortgage term for those surveyed and down.

A borrower made a mortgage loan 7 years ago for 160000 at. Millennials ages 25 34 were the least likely to know any home buying terms. A formal or informal arrangement between a lender and a borrower where the lender agrees to offer special terms such as a reduction in the rate or closing costs for a future refinancing as.

A co-signer or co-borrower is someone who agrees to take full responsibility to pay back a mortgage loan with you. Mortgagee The lender in a mortgage agreement. Fixed-rate mortgages provide borrowers with an established interest rate Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given.

Condition in a mortgage that gives the lender the right to require immediate repayment of the loan balance if regular. A mortgage lender that sells the loans it originates into the secondary market shortly after closing as opposed to holding the loans in portfolio. What term BEST describes the borrower who is personally liable for a debt obligation related to the purchase of a home.

What term best describes the borrower who is personally liable for a debt obligation related to the purchase of a home. A borrower in a mortgage transaction is also known as the mortgagor. A borrower takes out a 30-year mortgage loan for 250000 with an interest rate of 5.

Mortgagor A second mortgage is a junior lien mortgage that is. The person people or entity receiving a loan from a lender or bank also known as the mortgagee. A mortgage also referred to as a mortgage loan is an agreement between you the borrower and a mortgage lender to buy or refinance a home without having all the cash.

New Real Estate Term And Definition To Guide You In Your Real Estate Journey Real Estate Terms Real Estate The Borrowers

Solved 13 Vocabulary Mortgage Related Concepts And Chegg Com

What Is Everyone Talking About Basic Short Sale Dictionary Glossary Loan Modification Shorts Sale Standard Works

No comments for "What Term Describes the Borrower in a Mortgage"

Post a Comment